Top 10 investment strategies?

One of the most successful investment strategies is value investing. This approach involves identifying undervalued stocks with strong fundamentals. By carefully analyzing financial statements and market trends, investors can find stocks that are trading below their intrinsic value.

One of the most successful investment strategies is value investing. This approach involves identifying undervalued stocks with strong fundamentals. By carefully analyzing financial statements and market trends, investors can find stocks that are trading below their intrinsic value.

Warren Buffet's 2013 letter explains the 90/10 rule—put 90% of assets in S&P 500 index funds and the other 10% in short-term government bonds.

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

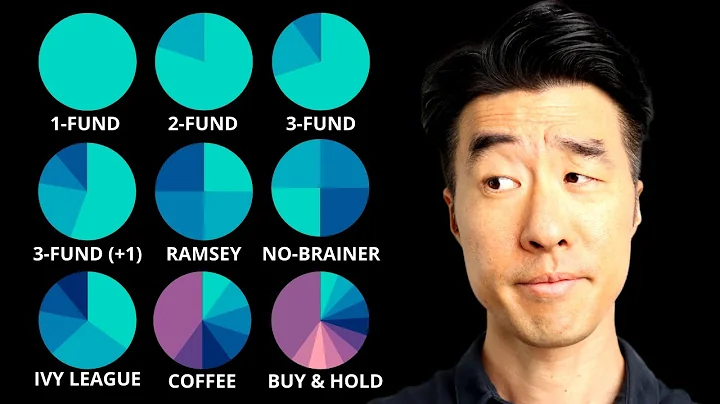

- Funds.

- Stocks.

- Alternative investments and cryptocurrencies.

- Real estate.

- Draw a personal financial roadmap. ...

- Evaluate your comfort zone in taking on risk. ...

- Consider an appropriate mix of investments. ...

- Be careful if investing heavily in shares of employer's stock or any individual stock. ...

- Create and maintain an emergency fund.

Chief among them, of course, is Rule #1: “Don't lose money.” And most of all, beat the big investors at their own game by using the tools designed for them!

- Never lose money. ...

- Never invest in businesses you cannot understand. ...

- Our favorite holding period is forever. ...

- Never invest with borrowed money. ...

- Be fearful when others are greedy.

The 90/10 strategy calls for allocating 90% of your investment capital to low-cost S&P 500 index funds and the remaining 10% to short-term government bonds. Warren Buffett described the strategy in a 2013 letter to his company's shareholders.

Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. The ARV of a property is the amount a home could sell for after flippers renovate it.

5: The 10, 5, 3 Rule You can expect to earn 10% annually from stocks, 5% from bonds, and 3% from cash. 6: The 3-6 Rule Put away at least 3-6 months worth of expenses and keep it in cash. This is your emergency fund.

What is the smartest thing to invest in right now?

- Long-term corporate bond funds. ...

- Dividend stock funds. ...

- Value stock funds. ...

- Small-cap stock funds. ...

- REIT index funds. ...

- S&P 500 index funds. ...

- Nasdaq-100 index funds. ...

- Rental housing. Overview: Rental housing can be a great investment if you have the willingness to manage your own properties.

- High-yield savings accounts.

- Certificates of deposit (CDs) and share certificates.

- Money market accounts.

- Treasury securities.

- Series I bonds.

- Municipal bonds.

- Corporate bonds.

- Money market funds.

Buy-and-hold investments: Buy-and-hold investing refers to making an initial investment, and maintaining the asset until it appreciates. The simplest example of this is purchasing stocks and then selling them after the shares increase in value.

1. Buy and Hold. Buying and holding investments is perhaps the simplest strategy for achieving growth. If you have a long time to invest before needing your money, it can also be one of the most effective.

Taking a buy-and-hold approach to investing is both the simplest and most dependable way to achieve substantial portfolio returns.

The 70/30 rule is a guideline for managing money that says you should invest 70% of your money and save 30%. This rule is also known as the Warren Buffett Rule of Budgeting, and it's a good way to keep your finances in order.

Golden Rule #1: Don't spend more than you earn

Basic money management starts with this rule. If you always spend less than you earn, your finances will always be in good shape. Understand the difference between needs and wants, live within your income, and don't take on any unnecessary debt. Simples.

Spend Less and Save More

Almost every financial advisor would say this. However, it is the key to your financial success. Though it is boring, only by spending less and saving will help you through your wealth management process. To create wealth, you need to have surplus funds to invest.

Buffett's “Rule 1: Never lose money. Rule 2: Never forget Rule 1” reflects his emphasis on capital preservation. For him, avoiding losses is paramount because recovering from a financial setback demands disproportionately larger gains. For example, if I lose 50%, I've got to gain 100% to get back to where I was.

— Warren Buffet's three-step prioritization strategy involves writing down 25 goals, selecting the top five, and focusing solely on those. What is the 80/20 rule? — The 80/20 rule states that 80% of desired results come from 20% of efforts, emphasizing the importance of working smart rather than just working hard.

What is Warren Buffett's 2 list strategy?

Buffett's Two Lists is a productivity, prioritisation and focusing approach where you write down your top 25 goals; circle your 5 highest priorities; then focus on those 5 while 'avoiding at all costs' doing anything on the remaining 20.

Warren Buffett 1930–

Rule No 1: never lose money. Rule No 2: never forget rule No 1. Investment must be rational; if you can't understand it, don't do it.

As there's no magic age that dictates when it's time to switch from saver to spender (some people can retire at 40, while most have to wait until their 60s or even 70+), you have to consider your own financial situation and lifestyle.

Buffett's favorite ETF

portfolio: the SPDR S&P 500 ETF Trust (NYSEMKT: SPY) and the Vanguard 500 Index Fund ETF (NYSEMKT: VOO). Both are index ETFs that track the S&P 500.

The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment approach that involves flipping a distressed property, renting it out and then getting a cash-out refinance on it to fund further rental property investments.